When you decided to open your own business, you probably envisioned a successful venture doing something you love.

You probably did not envision being immersed in paperwork, such as payroll and benefit administration. Many small business owners, in an effort to save themselves the aggravation (and in turn, reduce costs) turn to employee leasing.

So, what exactly is a leased employee? In general terms, a leased employee is a hired, but not permanent member of the staff, who is employed by both a leasing organization (Professional Employer Organization) and the business owner (you). Employment responsibilities are shared, but the advantages to you range from acquiring someone with a specialized skill set required for short-term projects to reducing costs for the employer.

When it comes to retirement plans, having leased employees can make things a little complicated. The Internal Revenue Code, specifically IRC Sec 414(n)(2), states ”any person who is not an employee of the recipient and who provides services to the recipient if— (A) such services are provided pursuant to an agreement between the recipient and any other person (in this subsection referred to as the ‘‘leasing organization’’), (B) such person has performed such services for the recipient (or for the recipient and related persons) on a substantially full time basis for a period of at least 1 year, and (C) such services are performed under primary direction or control by the recipient.”

A leased employee, as stated in the plan document, may be an excluded class, which would make them ineligible for benefits; however, they need to still be reported in the year-end data to be included in testing. Keep in mind, a leased employee is NOT a part-time, temporary, or seasonal employee. These classifications have entirely different rules regarding plan benefits.

If a leased employee is with the employer for more than a year, they may become entitled to some of the benefits of “common-law” employees. Meaning that if they meet eligibility requirements, they may be included in the recipient employer’s retirement plan. Although they would benefit from being part of the employer’s retirement plan, unless offered employment by the recipient employer, the leased employee remains an employee of the leasing agency. To avoid this issue of required retirement benefits to these employees, be sure to “rotate” the leased staff on an annual basis.

If it has been determined that the plan is a member of a controlled group, each member of the controlled group is deemed to be part of a single employer. Therefore, if a leased employee works for several employers who are members of a controlled group, he/she would accrue continuous service under a single employer. This may result in a leased employee unexpectedly reaching eligibility status.

A leased employee may be employed for a longer tenure, and can be a member of an excluded class of employees IF the following conditions apply:

-

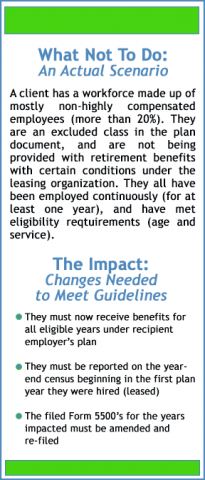

- Leased employees do not represent more than 20% of the recipient’s non-highly compensated workforce

Employee is covered by a plan sponsored by the leasing organization that provides for the following:

-

- Money Purchase Pension Plan with a nonintegrated employer contribution rate of at least 10%; immediate and full vesting

- Immediate eligibility for each employee of the leasing organization

If these conditions are met, the leased employee receives retirement benefits from the leasing organization, which are then attributed to the recipient employer.

Bottom line: The Rainmaker Plan and leased employees can work together as long as the guidelines are followed. If you are a Benetrends client and have any questions, please refer to your Retirement Plan Analyst. If you are considering entrepreneurship and want to know more, please fill schedule a consultation.