There is truth that the small business economy can – and will – lead to our economic recovery post-COVID.

While the US takes small steps toward a new normal, small businesses have been taking great leaps forward.

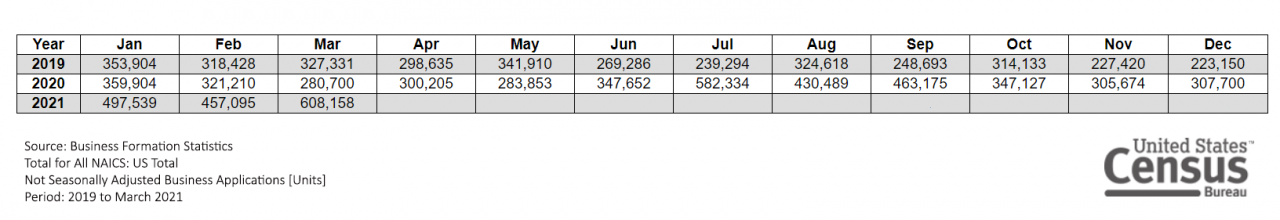

There was a temporary dip in new business applications in between February and May 2020 but came back strong during the remainder of 2020. Overall, there was a 24.18% increase in applications from 2019 to 2020, and this year the numbers are looking even better. The US Census Bureau Business Formation Statistics show that in the first quarter of 2021, over 1.55 million new business applications were submitted.

The surge in entrepreneurship stemmed from laid-off employees due to the shutdown of businesses last year. Rather than seeing their loss of employment as a hurdle, they found opportunities to meet the changing needs of consumers. Some of the businesses that have appeared (or re-appeared) include:

- cleaning services

- delivery services

- home fitness equipment/virtual workout

- telehealth

- tutoring

- drive-in theaters

Unlike other economic downturns, the supply of funding wasn’t cut off; in fact, small businesses were able to receive assistance through the SBA loan programs. With the large number of new businesses, even the SBA was unable to meet the demand, shortening a loan forgiveness period from 6 to 3-months.

Throughout it all, Benetrends has been helping these entrepreneurs fund their businesses. Our comprehensive suite of funding options, from SBA assistance to our signature 401(k)/IRA rollover funding, known as ROBS (Rollover as Business Startups), have given small business owners the funding they need to launch their dreams of business ownership.

If you are ready to start your own business, now is the time to get your funding in order. Schedule a consultation to learn more.