We have been very watchful of the tax reform that has been fiercely debated in Washington and was signed into law on December 22, 2017.

With the help of our tax partners, below are some of the highlights regarding the reform’s effect on the ROBS business:

-

-

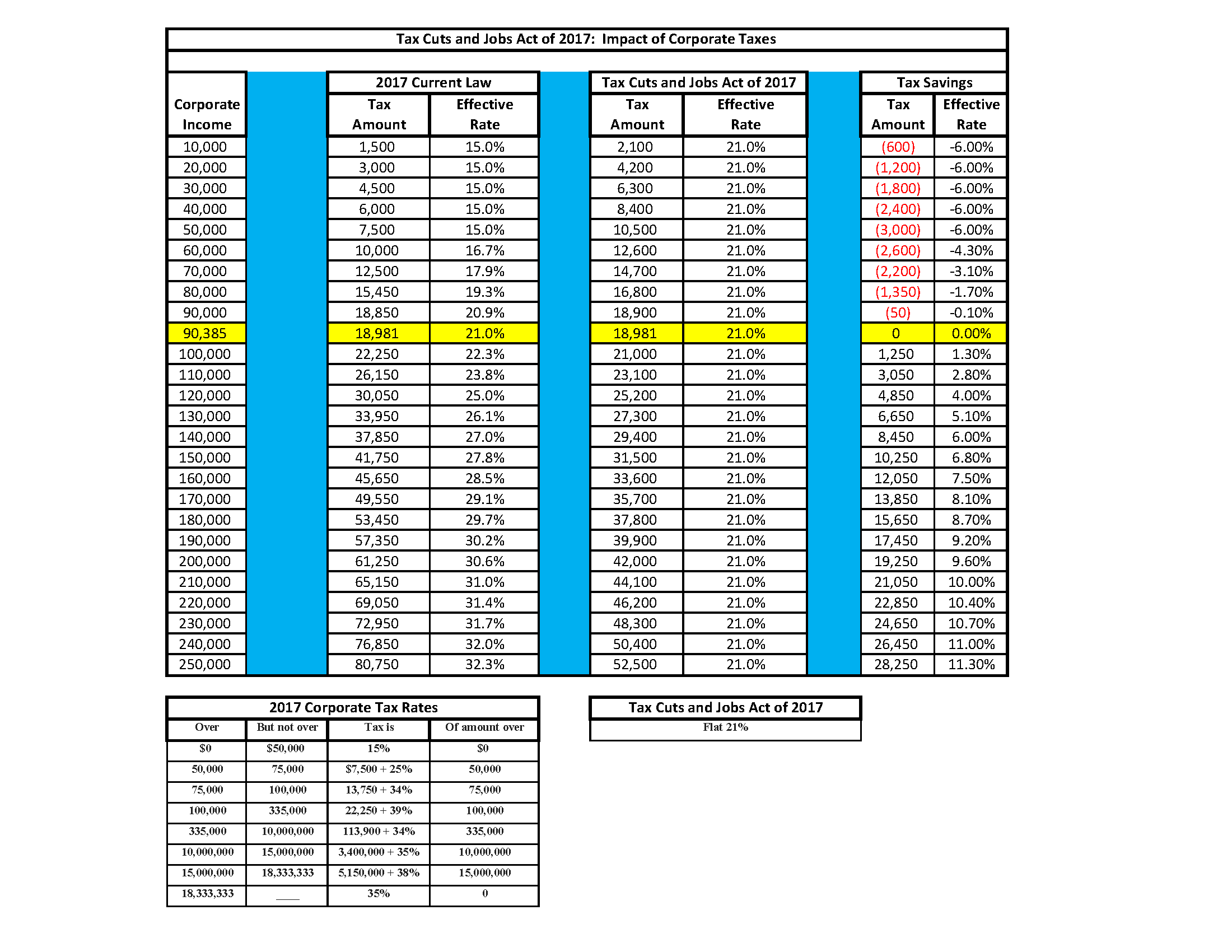

- The graduated corporate tax bracket is no longer in effect. C corporations will now be taxed at a flat rate of 21% on taxable income. This eliminates situations where C corporations were taxed as high as 39% on taxable income.

- The tax rate for C corporations is going to be significantly mitigated. This is true for corporations retaining profits as well as corporations that wish to sell their assets. The corporate tax burden has been lowered by approximately 40% for the majority of profitable businesses. This could potentially mean that unhappy business owners are more likely to part ways with their businesses while the tax consequence on the sale of the business is significantly diminished.

- Lower personal tax rates also make the C corporation more appealing when clients wish to pay themselves a salary.

- The reform has eliminated the corporate alternative minimum tax (AMT) which is another significant tax savings for C corporations.

- With the flattening of the corporate tax rate to 21%, the change means that any C corporation with taxable income of more than $90,385 will pay less corporate tax under the new law. The breakdown detailing the taxation of taxable income under the old tax law vs. the new tax law can be seen below:

-

The IRS provided a side-by-side comparison of changes made by the Tax Cuts and Jobs Act that affect businesses, allowing them to determine how these changes will affect their business situation. This article examines changes to business taxes, including deductions, depreciation, expensing, tax credits, and other tax items.

As you can see, the tax reform will positively impact our ROBS clients, both present and future. We would like to thank our partners for their insight into the impact of this tax reform. To learn more, schedule a consultation or download The Definitive Guide to 401(K)/ROBS Business Funding e-book.