The Great Greek Mediterranean Grill

We have partnered with Benetrends to jumpstart your entrepreneurial journey!

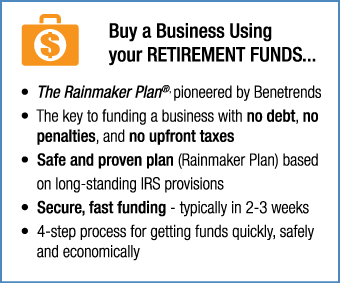

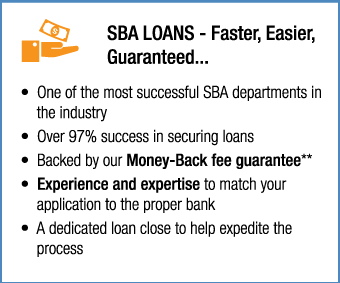

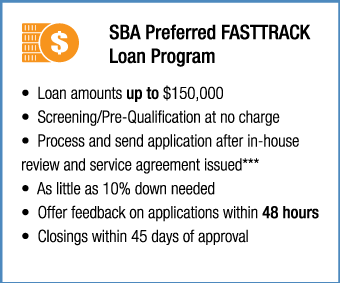

Funding is one of the most important components in buying a franchise/business. Benetrends has been funding America’s entrepreneurs for over 35 years, offering a comprehensive suite of funding options covering nearly every type of business situation. The most popular programs are the Rainmaker Plan® (IRA/Rollover) and SBA small business loan programs.

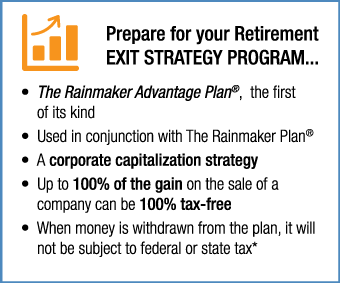

And Benetrends continues to provide out-of-the-box funding solutions with ROBS+™, a corporate capitalization strategy modeled after the Rainmaker Plan®, that is designed to mitigate or eliminate the taxes due on the sale of a business. Benetrends also offers Securities Backed Line of Credit and Equipment Leasing.

**SBA Loan Money-Back Fee Guarantee: If Benetrends accepts your application for processing, we guarantee your application will be approved or we refund 100% of our fee.

***Once approved, a financial package will be needed for verification.

What is Your “Fundability”?

Pre-Qualify for funding to determine how much and what sources of options are available to you.

Plus, you’ll have faster access to funding, allowing you to open your new business sooner.

This total amount is estimated based on all available options, including cash, retirement funds, stocks and bonds, plus an estimated SBA loan amount.

Additional factors may impact the amount of funding available, and not all funding options can be used in combination. Please consult with a Benetrends representative to discuss your individual situation and confirm actual results.

This tool is intended to be used for educational purposes. Results should not be deemed definitive or regarded as a promise or final determination of funding. It is an estimate based on the information provided to us, and therefore must be validated by Benetrends for accuracy. Some factors which could impact this amount include: liquid assets available after closing, outside or secondary source of income, applicable or transferable management skills and the ability to satisfy SBA collateral requirements.